Healing Your Relationship with Money

Financial Therapy | Greensboro, NC

In-Person or Online Financial Therapist

Healing Your Relationship with Money

Why Financial Therapy is the Missing Piece

If you’ve ever felt a knot in your stomach when opening a credit card statement, or found yourself in the same recurring argument with your partner about “frivolous spending,” you know that money is never just about the math.

It’s about safety, worth, power, and love. Despite how much we track our spreadsheets, most of our financial decisions are driven by subconscious beliefs formed long ago. If you are tired of the cycle of anxiety, shame, and conflict, it’s time to move beyond budgeting and start healing.

Why You Feel Stuck: The Intrapsychic Roots of Financial Stress

Do you ever wonder why you “know” what to do, yet you can’t seem to do it? This disconnect often stems from internalized money scripts—the unconscious beliefs about money we develop in childhood.

Breaking the Cycle of Financial Anxiety and Shame

Living with chronic financial anxiety isn’t just a result of your bank balance; it’s an intrapsychic phenomenon. You might experience:

- Financial Avoidance: Leaving bills unopened because the “threat” feels too big to face.

- Money Vigilance: An inability to enjoy your earnings because you’re waiting for the other shoe to drop.

- Compulsive Spending: Using shopping as a temporary dopamine hit to soothe underlying emotional pain or loneliness.

Dr. Tom Murray, a Certified Financial Therapist™ (CFT™), helps you peel back these layers. We look at the “why” behind the “what,” helping you resolve the internal tension that keeps you stuck in self-sabotaging patterns.

Restoring Intimacy: How Money Impacts Your Relationship

Money is one of the leading causes of divorce, but it’s rarely the currency itself that causes the rift. It’s what the money represents.

Ending the Cycle of "Financial Infidelity" and Conflict

In intimate relationships, different money personalities can lead to deep resentment. You might be struggling with:

Power Imbalances: Feeling like you have no say because you earn less, or using your higher income to control your partner’s choices.

Conflicting Money Values: One partner views money as a means of “freedom” (spending), while the other views it as a means of “security” (saving).

Loss of Trust: Hiding purchases or debt from your partner to avoid judgment, leading to a breakdown in emotional intimacy.

Financial therapy offers a neutral, clinical space to navigate the complex dynamics of these relationships. You will learn how to communicate your needs without triggering your partner’s defenses, turning financial friction into an opportunity for a deeper connection.

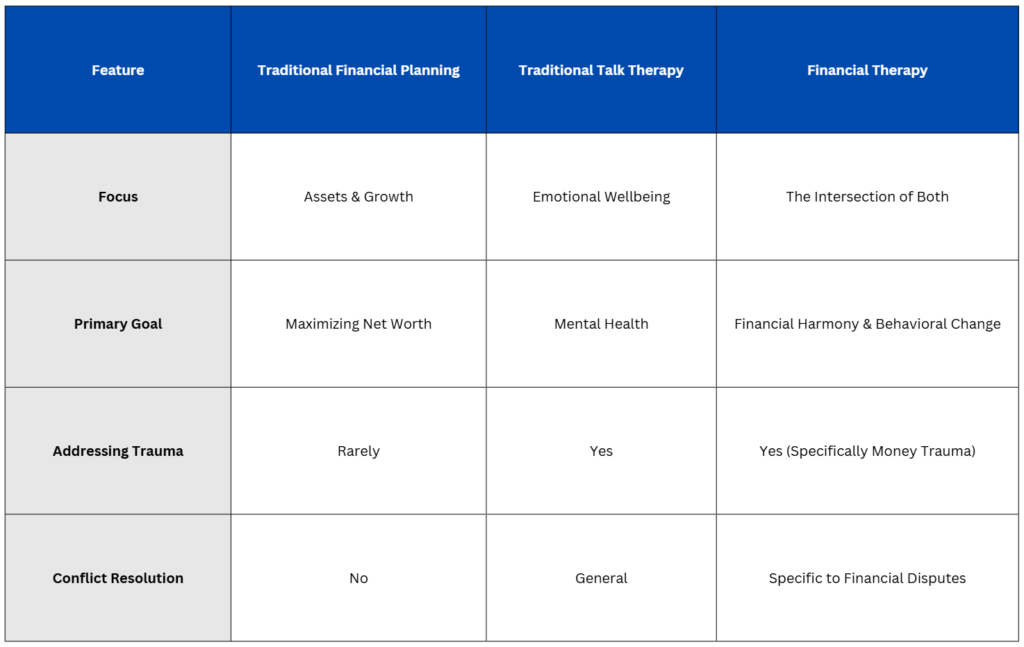

The Benefits of Working with a Certified Financial Therapist

You might have a financial advisor for your investments and a traditional therapist for your mental health. A Certified Financial Therapist bridges that gap, integrating behavioral health with practical financial coaching.

The Benefits of Working with a Certified Financial Therapist

- Money Script Discovery: Identifying the “inherited” beliefs that dictate your financial behavior.

- Couples Financial Counseling: Facilitating vulnerable conversations to align your shared future.

- Overcoming Financial Trauma: Healing from past experiences of poverty, sudden wealth, or financial abuse.

- Values-Based Spending Plans: Creating a “budget” that feels like an expression of your joy, not a restriction of your life.

Take the First Step Toward Financial Peace of Mind

You don’t have to carry the weight of financial shame anymore. Whether you are looking to save your marriage from constant money arguments or you want to stop the internal spiral of “never feeling like enough,” help is available.

Are you ready to change your narrative?

Stop letting your bank account dictate your self-worth and your relationship’s health. Work with a specialist who understands that your net worth is not your self-worth.

Meet Your Certified Financial Therapist™

As many of you know, I was a welfare-baby. Money felt tight, stressful, and full of limits. Those early lessons shaped how I saw money, success, and what felt possible.

Over time, I learned that changing income matters less than changing mindset. Learning how money works, how wealth grows, and how to set clear goals changed my life. That shift led me to business ownership, helping others with money stress, and earning my MBA.

I have now completed the requirements for the Certified Financial Therapist™ designation. This work blends psychology, behavior, and practical money skills. It fits naturally with how I already help individuals, couples, and families.

I am grateful for the training and standards set by the Financial Therapy Association. This step deepens my ability to help people reduce money stress and build healthier lives.